The following information is for our customers who haven't gotten their tax information on Stripe verified. See below to check on the status, and how to update information if not yet verified. If the tax information is not verified, Stripe will stop the account from making charges and receiving payouts.

How to Check Verification Status

How to Update Business Information

Check Verification Status

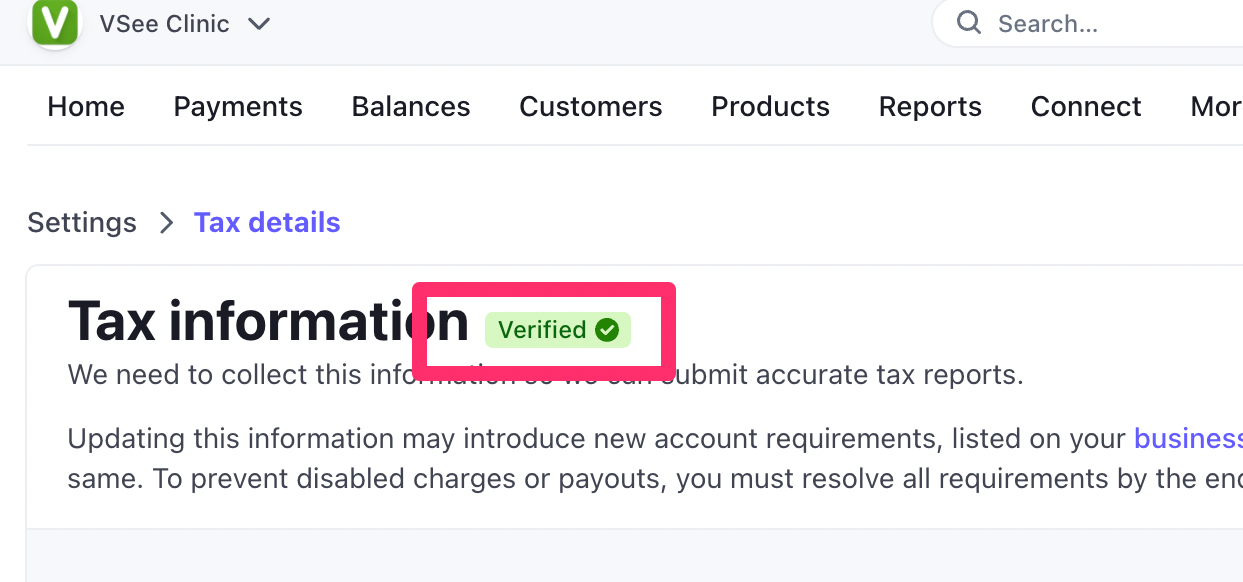

Make sure that the status is VERIFIED on this page - https://dashboard.stripe.com/settings/taxation

Update Business Information

If it is not verified, you can update the business information as an account owner of the Stripe account by going to - https://dashboard.stripe.com/settings/update

IMPORTANT! The combination of your name and Employer Identification Number (EIN) must exactly match the one listed on your IRS documents (e.g., Letter 147C or SS-4 Confirmation letter), including capitalization and punctuation.

Scope and Limitations:

The information above is for our customers who haven't gotten their tax information on Stripe verified.

Related Article:

Connecting a Stripe Account to Your Clinic

If you have any questions, please contact us at help@vsee.com

Last updated on: 23 June 2022